How is Interoperability changing banking?

Interoperability has revolutionised banking for good. So much of our everyday life depends on computers’ ability to exchange and effectively use the information available. But what does that mean?

Interoperability refers to the ability of different devices and software applications to communicate, exchange data, and work together effectively. Additional components or systems can seamlessly interact and interoperate with each other, regardless of their differences in design, programming languages, platforms, or technologies.

It is essential in various domains, including computer networks, telecommunications, healthcare, finance, transportation, etc. It enables different entities, such as devices, software applications, or organisations, to exchange information, share resources, and collaborate efficiently.

It is reshaping the finance industry, transforming financial institutions’ operations and service delivery. It enables customers to seamlessly send and receive money, facilitating instant fund transfers between bank accounts through mobile platforms. This interoperability level has revolutionised how individuals conduct financial transactions, offering convenience and efficiency.

Customers benefit from an enhanced value proposition of digital services when services are interoperable, functioning collaboratively instead of in isolation.

Benefits of adopting Interoperability

Interoperability can inspire FSPs to innovate and raise the bar on the quality of services they provide. Customers frequently select the provider that their friends, suppliers, or clients use in the absence of it to conduct business with them directly. This strategy may result in the emergence of market leaders. Customers are more likely to select a service provider in an interoperable market based on value proposition, level of customer care, and pricing than the company’s clientele.

It also aids in developing economies of scale and ensures the financial viability of the payment service, which may lower some entry barriers for smaller suppliers. Additionally, it may encourage service providers to create collaborative tools like fraud monitoring and AML/CFT checks to stop money laundering and the funding of terrorism (CFT), which would reduce operational costs. Due to these factors, instant payment interoperability might encourage low-income clients to access and use payment services, increasing and maintaining financial inclusion.

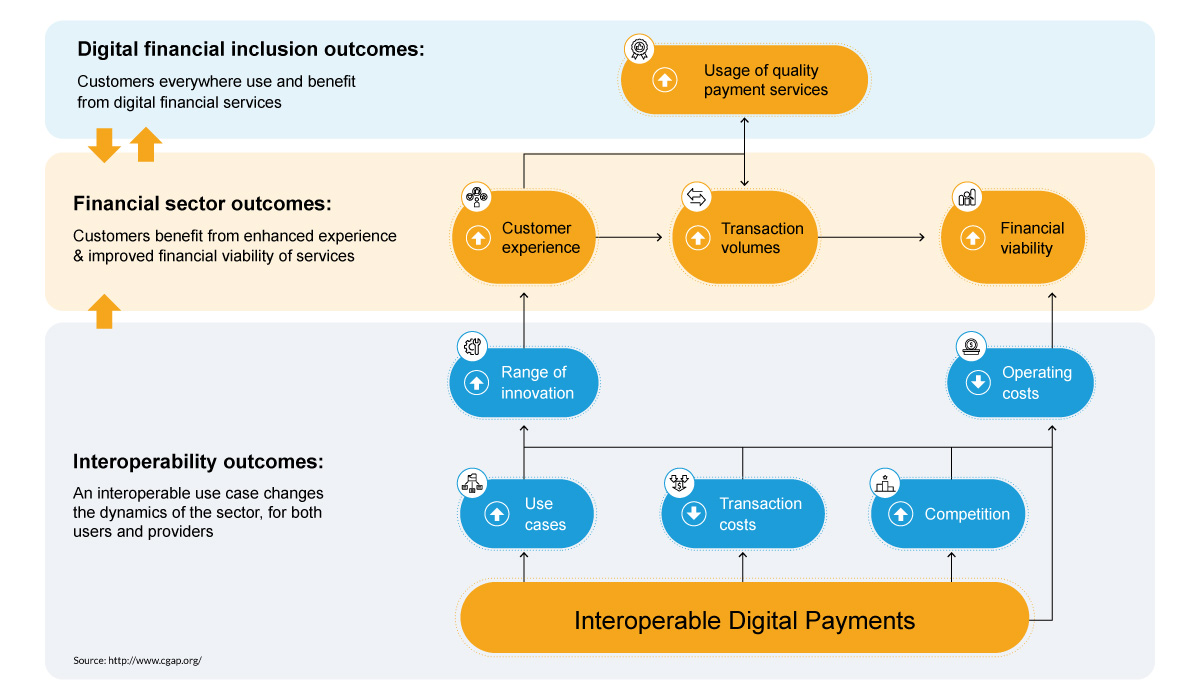

In the image below, you can see how interoperability enables financial inclusion in different levels:

Interoperability fosters competition lowers provider expenses, and expands the array of services accessible to customers. This establishes the groundwork for enhanced customer experience and sectoral expansion and bolsters the financial viability of payment systems, ultimately yielding positive outcomes for the financial industry. As customer experience improves, there is a rise in the utilisation of instant payment services and achievements in financial inclusion, creating a virtuous cycle where the development of the financial sector contributes to and strengthens financial inclusion.

Overcoming digital hurdles with Binimoy in Bangladesh

Smart Bangladesh has always been the vision, and in an attempt to achieve the same, Digital Bangladesh initiatives were established. With the launch of Binimoy, an Interoperable Digital Transaction Platform (IDTP), Bangladesh reached a significant milestone in their financial inclusion initiatives. The revolution of IDTP started in 2022, and it enables fund transfers across mobile financial services, banks, and PSPs in a seamless manner.

Binimoy is transforming instant payments in Bangladesh in the following ways:

Seamless Integration:

Binimoy, being an interoperable platform, allows different financial institutions, banks, and payment service providers to connect and integrate their systems. This seamless integration enables users to initiate instant payments directly from their accounts, regardless of which bank or financial institution they hold their funds with. It eliminates the need for multiple apps or accounts and provides a unified payment experience.

Expanded Access:

By promoting interoperability, Binimoy facilitates widespread access to instant payment services. It enables individuals, businesses, and merchants to transact seamlessly across different platforms and systems, irrespective of their financial service provider. This expanded access helps in driving adoption and usage of instant payment solutions, fostering financial inclusion and economic participation.

Enhanced Convenience:

With Binimoy, users can enjoy the convenience of instant payments in various scenarios. They can make real-time payments for e-commerce purchases, utility bills, peer-to-peer transfers, or merchant transactions. The interoperable nature of Binimoy ensures that funds can be transferred quickly and securely between different accounts and payment channels, providing users with a hassle-free and efficient payment experience.

More disruptive technologies in banking ahead? What’s in store for Bangladesh

An interoperable digital transaction platform like Binimoy has the potential to transform instant payments by promoting seamless integration, expanding access, enhancing convenience, reducing friction and costs, and driving innovation in the payment ecosystem. But there is undoubtedly more to digital transformation for Bangladesh.

The future of banking digital transformation in Bangladesh holds significant potential for reshaping the financial landscape. It will be marked by increased adoption of mobile banking, open banking initiatives, advanced technologies like AI and biometrics, personalised services, and a focus on financial inclusion and cybersecurity. These developments are expected to improve access, convenience, and customer experience while driving economic growth and innovation in the financial sector.