In the ever-changing landscape of retail banking, a major transformation is underway!

This digital wave is reshaping banking as we know it. Motivated by evolving needs and easy access to advanced technologies, customers now expect more from their banking journeys than ever before. Today’s younger generation exhibits a heightened focus on saving, and their tolerance for choppy customer experiences is at an all-time low. In 2022, the global digital payments transactions surpassed USD 8 trillion, showcasing a remarkable surge in the adoption of digital wallets worldwide. Emerging players such as neobanks, digital banks, and challenger banks leverage innovative technologies to position themselves as the preferred choice for customers.

In this critical scenario, banks must confront a crucial question: Are they weathering the digital storm equipped with customer-centric offerings, or are they struggling to keep pace due to outdated legacy systems?

The winds of change blow with great intensity, and the future of retail banking hinges on banks’ ability to embrace innovation and digital transformation, delivering hyper-personalised solutions that cater to customers’ ever-evolving needs. Success depends on banks’ agility in the face of emerging trends and their commitment to providing seamless experiences that resonate with customers seeking convenience, security, and financial empowerment.

The pursuit of superior CX is an ongoing journey. As technology continues to evolve, we must evolve with it…

There is no doubt in that!

But, how can banks accelerate their digital transformation journey to meet the changing needs and preferences of the customer? Does prioritising customer-centricity guarantee that banks stay ahead of the curve and improve customer experience?

At present, merely 30% of financial companies have embraced a digital transformation strategy, indicating that a substantial portion of financial organisations still have a long way to go in terms of developing and implementing digitisation.

Additionally, there is an agreement amongst executives in financial institutions that their workforce was unprepared to embrace specialised technical skills and adapt to emerging technologies.

It is even more surprising to learn that there still exists a number of banks that are still unaware of the magnitude of the Industry 4.0 revolution.

This leads us to another question: where can banks begin?

In today’s ever-evolving banking industry, providing outstanding quality has become an imperative rather than a choice. Customers now expect nothing less than personalised and tailored experiences that align with their individual preferences. To meet these heightened expectations, banks must prioritise the enhancement of their digital capabilities.

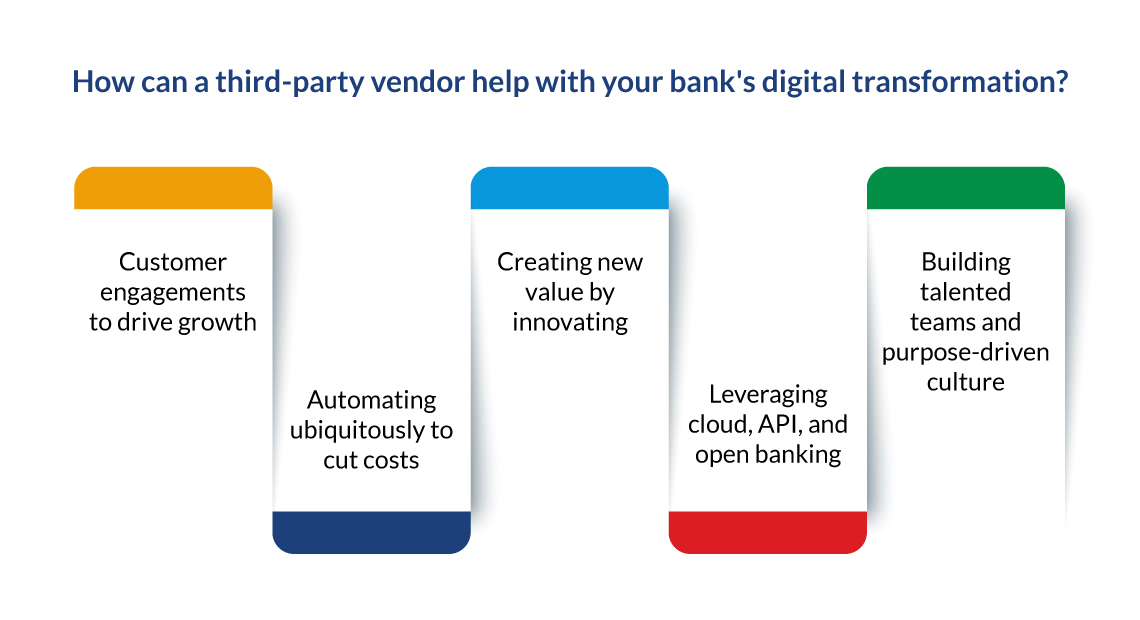

However, enhancing digital capabilities is not solely an internal endeavour. Collaboration with expert third-party vendors plays a crucial role in driving innovation and staying ahead in the competitive landscape. By partnering with specialised providers, banks can tap into their expertise, gain access to advanced technologies, and accelerate their digital transformation journey. This collaboration allows banks to deliver exceptional customer experiences more efficiently and effectively, meeting and surpassing the demands of today’s tech-savvy customers.