A quick snapshot of Generative AI in India

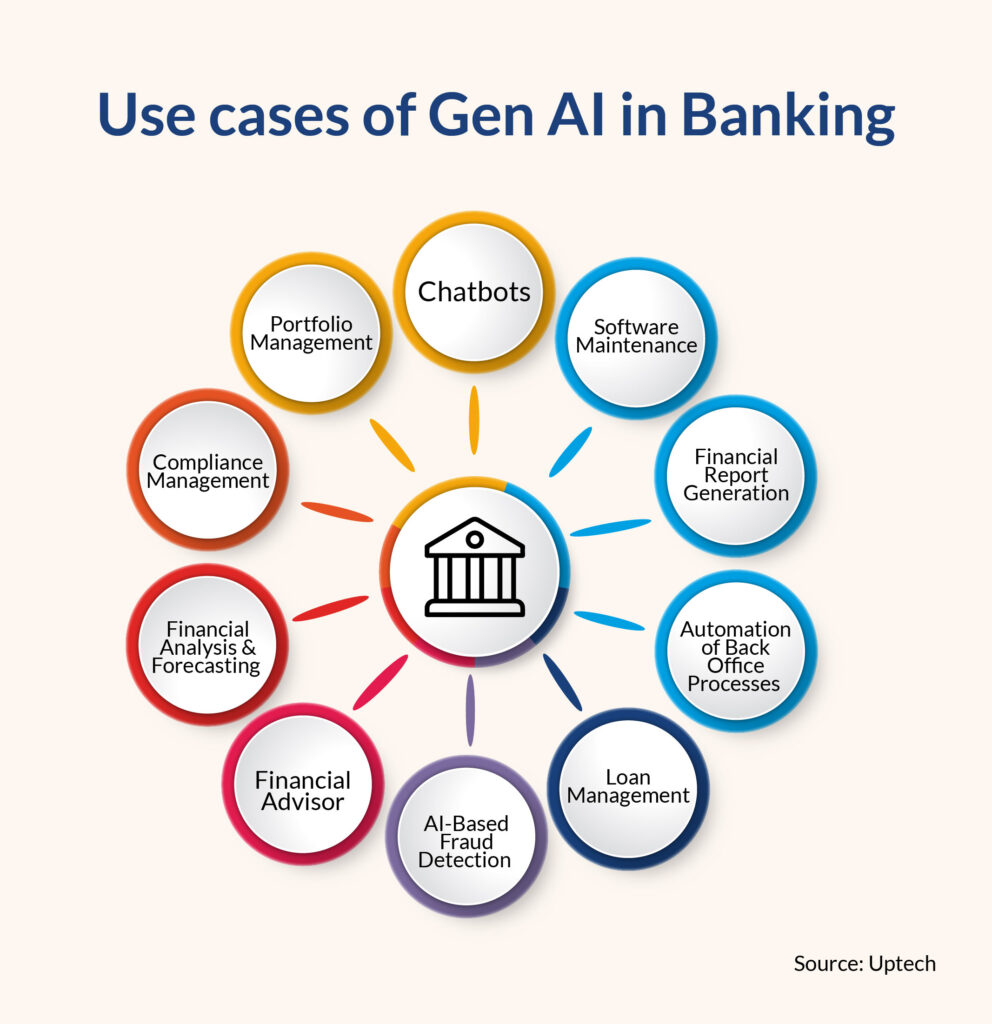

Here’s a closer look at the state of financial institutions and Generative AI (Gen AI).

According to findings, 78% of financial institutions today have either already planned to use Gen AI in their operations or are about to do so. 61% of this category are ready for a major shift, with the goal of reaching never-before-seen levels of efficiency and responsiveness with Gen AI. In particular, chatbots and virtual assistants—which deal directly with customers—were already being widely adopted by mid-2023. In particular, these technologies have already been used by 11 out of 12 public sector banks and 15 out of 21 private sector banks.

India’s banking industry is famous for being the first to use AI, with the highest AI maturity index. Due to this, applications of AI are anticipated to spark $447 billion in possible cost savings by 2023. The banking industry’s operational framework is changing due to this shift toward Gen AI, pointing the industry toward a future that will be highlighted by efficiency and cutting-edge innovations. It’s a pivotal time highlighting the financial sector’s strong transition to a tech-savvy, forward-thinking approach.

Let’s delve into understanding what it is about Gen AI that is positively influencing the future of banking.

How Gen AI is shaping the future of banking

1. Enhanced Customer Experience

Banks are leveraging generative AI to transform every client interaction into a valuable insight. By quickly processing vast databases and integrating with pricing engines, this technology provides real-time, personalised audio responses that rival the guidance from human advisors. The result is a more impactful and tailored customer experience.

2. Cost Reduction and Efficiency

Generative AI excels in automating routine tasks and simplifying complex operations. Banks utilise this technology to efficiently manage large datasets and generate easily accessible content for both employees and clients. This not only reduces costs but also enhances the overall responsiveness and agility of banking services, benefiting both the institutions and their customers.

3. Risk Management and Compliance

In the challenging landscape of banking regulations, generative AI offers a crucial advantage by enhancing compliance and risk management. This technology keeps up with regulations and anticipates potential compliance issues, ensuring that banks operate smoothly and avoid costly legal pitfalls.

4. Personalized Financial Planning

Generative AI empowers banks to offer bespoke financial advice, tailored to individual customer profiles. By analysing past transactions, spending habits, and financial goals, AI systems can craft personalised financial plans that help customers manage their finances more effectively and reach their financial objectives sooner.

The potential for generative AI in banking is immense, with global investment expected to reach $85 billion by 2030, according to Juniper Research. Major financial institutions are already harnessing the power of generative AI to streamline operations and deliver superior services, setting new benchmarks for the future of the industry.